5 fast facts to avoid taking Social Security too early

September 27, 2023

Financial professionals and plan sponsors are often well aware of the pitfalls of taking Social Security too soon. But are your plan participants?

For those approaching retirement, it’s especially important to make sure they understand how claiming Social Security benefits before reaching full retirement age could affect their retirement income for the long term.

Share these fast facts about Social Security to help enable your plan participants make informed decisions about claiming benefits.

Fact #1: Full retirement age is 67 for most

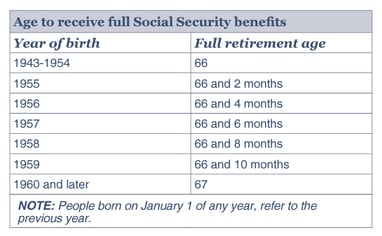

Many Americans have the misconception that age 65 is when full Social Security benefits kick in. But someone who turns 62 this year will need to wait another five years to reach that milestone. While individuals could claim their benefits at age 65, their monthly Social Security checks will be about 15% less than if they waited until age 67. Waiting until age 70 reaps the biggest rewards, receiving an average of 43% more than taking Social Security at age 65, and 77% more than if they start at age 62.1 The chart below lists the full retirement age by year of birth.2

Fact #2: Working retirees can still claim Social Security benefits

Individuals can continue to work as much as they want once they reach full retirement age and still receive their full Social Security benefits. If younger than full retirement age and claiming Social Security, a person may have some benefit payments withheld if earnings exceed certain thresholds; they won’t see a decrease in their overall lifetime earnings, though, and could even be paid a higher monthly benefit once they reach their full retirement age.1

Fact #3: One in three 65-year-olds will live to age 90

And one in seven 65-year-olds will live to age 95! Increased longevity is great news, but it can also pose risks. Older individuals need to consider where their income streams will come from as their savings potentially dwindle over time, and they may need to plan for long-term care. A financial strategy can help and, thankfully, Social Security benefits won’t decrease over time.1

Fact #4: The average monthly Social Security benefit is $1,825

While nearly nine out of ten people age 65 and older receive Social Security benefits, it represents only 30% of the income of the elderly. Individuals should not rely on Social Security to provide a living wage, and need a financial plan to help them reach their retirement goals.3

Fact #5: It might not be too late if someone already filed

Some individuals regret claiming Social Security benefits before full retirement age and wish they could reverse their decision. Depending on when they began claiming benefits, there are options.

- If an individual hasn’t yet received a full year of benefits, they can file form <SSA-521—Request for Withdrawal of Application >to rescind a claim. Any benefits received prior to rescinding a claim must be repaid, however.4

- Individuals younger than full retirement age can continue to work and have $1 in benefit payments deducted for every $2 over a certain amount ($21,240 as of 2023). These funds can then be distributed once full retirement age is reached.5

- An individual can voluntarily suspend benefits if they’ve reached full retirement age, and then start to receive delayed retirement credits at age 70, resulting in higher benefit payments.6

There are several restrictions and requirements surrounding each of these options, so direct individuals to the Social Security Administration’s website (ssa.gov) for complete information.

Start the conversation

Discussions about when to claim Social Security should take place years before retirement, as part of developing a financial strategy. Use the above facts as conversation starters.

Even though waiting to claim Social Security benefits results in greater retirement income, there may be scenarios in which an individual prefers to begin receiving those benefits because they need the supplemental income before they reach full retirement age. Even then, it’s the responsibility of financial professionals to ensure they’re fully informed prior to making such a decision.

SOURCES

1 Social Security Administration, When to Start Receiving Retirement Benefits, January 2023

2 Social Security Retirement Benefits, accessed August 2, 2023

3 Social Security Administration, Fact Sheet, accessed August 2, 2023

4 Social Security Administration, Cancel Your Benefits Application, accessed August 2, 2023

5 Social Security Administration, How Work Affects Your Benefits, January 2023

6 Social Security Administration, Suspending Your Retirement Benefit Payments, accessed August 2, 2023